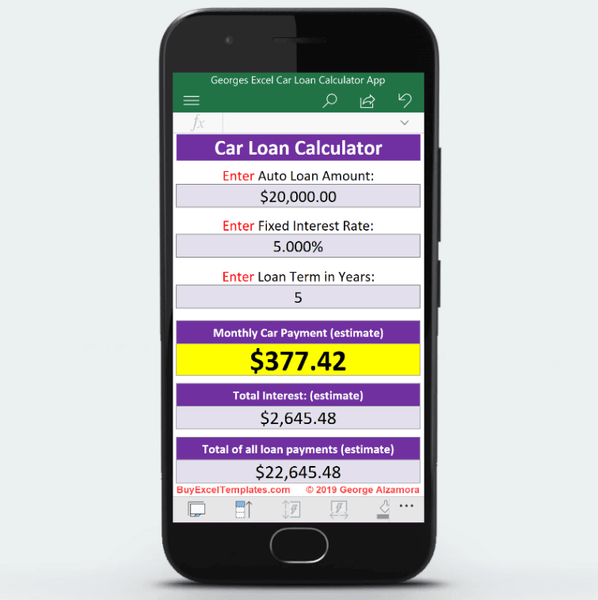

Fifth Third Bank, National Association does not provide tax, accounting or legal advice. Before getting yourself in debt, its important to leverage a Car Payment Calculator that helps you determine your monthly payment and. This information is provided for educational purposes only and does not constitute the rendering of tax or legal advice. Discover how much your monthly auto loan payment could be with Healthcare Associates Credit Unions car loan calculator. Actual returns and principal values will vary. This was my first time in my life financing a vehicle, and it was swift. Heres how you can get started: Choose your starting point. The example is not representative of any investment class or specific security. Most customers can get pre-qualification results in less than 5 minutes, and it doesnt impact your credit score. These calculations are hypothetical examples designed to illustrate the impact compounding can have. Fifth Third Bank, National Association, is not responsible for the content, results, or the accuracy of information. The information cannot be used by Fifth Third Bank, National Association, to determine a customer's eligibility for a specific product or service.Īll financial calculators are provided by a third-party and are not controlled by or under the control of Fifth Third Bank, National Association, its affiliates or subsidiaries. The results are estimates that are based on information you provided and may not reflect Fifth Third Product terms. This calculator is being provided for educational purposes only. The dealer will still take the trade-in, but instead of deducting 5,000 from your new car’s price, they’re going to add 5,000. Financial Insights About Us Customer Service Online Banking Login Branch & ATM Locator Search On the other hand, if you owe 25,000 on that 20,000 trade-in, you have what is called negative equity you owe more than your car is worth.Additional Sources of Capital for Small Businesses.Consider making extra payments, increasing your down payment or even refinancing your loan before you buy something new in order to reduce the amount of extra interest you would pay. Take advantage of this calculator to understand your monthly payments so that you can best grasp how the amount you still owe would affect the total cost of your new loan.

Purchasing a luxury vehicle outside of your budget.

Signing off on too long of a repayment term.There are a few common ways that borrowers become upside down on their car loan, including:

While it isn’t the worst-case scenario as a loan holder, it can make vehicle trade-in and future auto loan approval a challenge. Negative equity - also referred to as being “ upside down” - is when you owe more on your auto loan than the vehicle is worth. Making extra payments will also help you get out from being upside-down at a much faster rate. Doing so will adjust the monthly payment and total interest paid accordingly. If you want to check how extra payments will affect your cost, you can input them as well. Enter your information into the early loan payoff calculator below. You will now have the expected monthly payment along with the total principal and interest paid. The Bankrate Auto Loan Early Payoff Calculator will help you create the best strategy to shorten your car loan’s term. To use this calculator, simply enter the amount remaining on the loan you must pay, the amount borrowed on your new loan, the loan term and your interest rate.

0 kommentar(er)

0 kommentar(er)